Intel received significant backing from the SoftBank Group. SoftBank is investing $2 billion in Intel common stock. According to several reports, the investment is a bet on the future of advanced technology and semiconductor manufacturing in the United States.

SoftBank is buying Intel’s stock for $23 per share, a move that reflects the firm’s belief in the AI revolution.

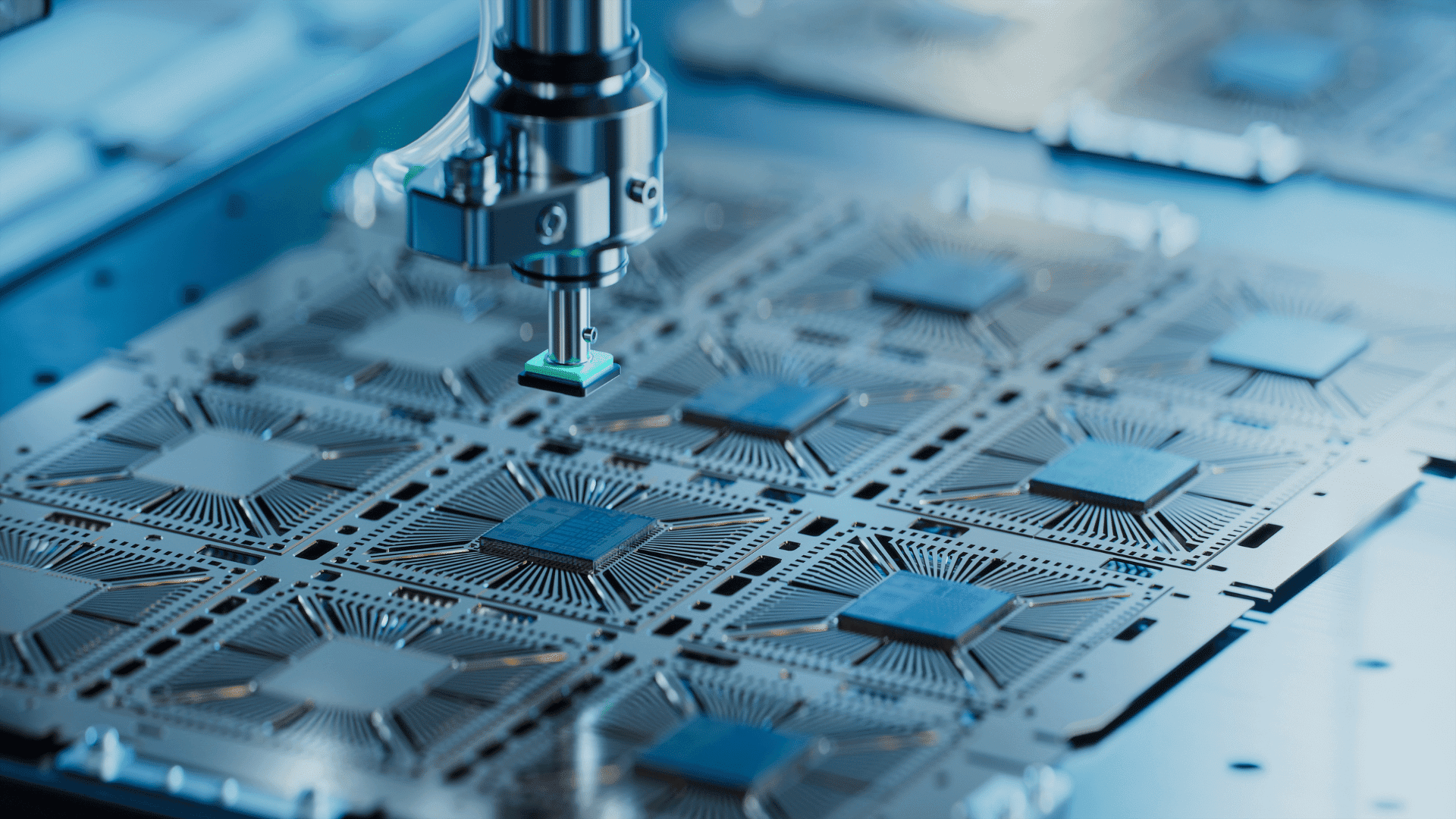

A Strategic Investment in AI and Semiconductors

SoftBank’s CEO, Masayoshi Son, highlights that semiconductors are foundational in every industry. “This strategic investment reflects our belief that advanced semiconductor manufacturing and supply will further expand in the United States, with Intel playing a critical role,” he said.

Intel’s CEO, Lip-Bu Tan, expressed excitement about a strengthened partnership and a commitment to technology. “I appreciate the confidence he has placed in Intel with this investment,” Tan said.

Reports indicate that this investment was crucial for Intel. According to a report from CNBC, the company has struggled with competition, and its stocks have taken a hit. SoftBank’s investment makes the firm the fifth-biggest shareholder in Intel. They own about 2% of the company now. The investment comes at an opportune time as Intel’s efforts to grow its chip manufacturing have yet to secure a major customer.

This investment fits right with SoftBank’s larger strategy of making big moves in the chip and AI sectors. The firm’s past acquisitions include chip designer Arm. In addition, the firm has been involved in projects like “Stargate,” in collaboration with OpenAI and Oracle. Reports say that this involvement shows that SoftBank is actively trying to shape the future of AI.

There’s no question how important semiconductors are for the next wave of technological innovation. This partnership emphasizes those efforts.

“This strategic investment reflects our belief that advanced semiconductor manufacturing and supply will further expand in the United States, with Intel playing a critical role,” Son added.